"The general theme is that merchants – even small merchants – are rapidly & increasingly demanding omni-channel payments offerings," Ellis noted. That development came out of last year's acquisition of Weebly and has helped Square catch up from behind in e-commerce. Rival Square just last month announced revamps of its Square Online Store and Square for Retail, products that allow merchants to add e-commerce to their sales operations, including tools like Instagram selling, shipping and in-store pickup. "PayPal made a major investment in that direction their acquisition of iZettle, and Stripe has also moved in that direction," she said.

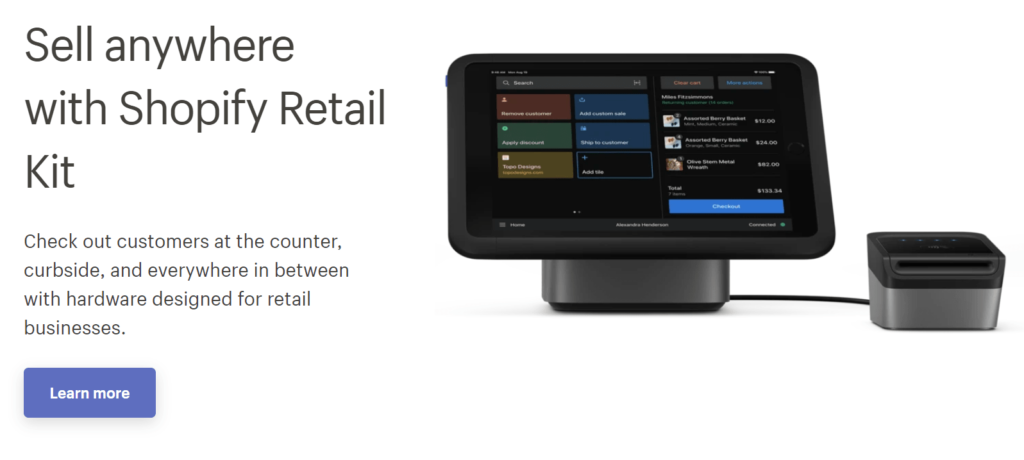

Shopify's new hardware set is another example of an online payments player extending into the store, she also said. niche players like Breadcrumbs … they all pretty much look alike & have similar capabilities." "Also, so far we have seen limited differentiation among players – e.g., Square's systems vs.

online payments," MoffettNathanson senior research analyst Lisa Ellis told Retail Dive in an email. "Small business payment facilitation is a crowded, but still under-penetrated market – the vast majority of small businesses still have the heavy, wireline terminals and separate in-store vs. "Systems like Shopify has introduced are the key to connecting both channels and building seamless experiences as online-first brands expand their in-store presence," he said in comments emailed Retail Dive.īut Shopify's isn't just competing with traditional POS systems. Shopify's new hardware is a "smart move" because traditional POS systems aren't usually so well connected for on and offline sales, according to Adam Corey, chief marketing officer of customer data platform Tealium.

0 kommentar(er)

0 kommentar(er)